Smart Info About How To Recover A Bad Debt

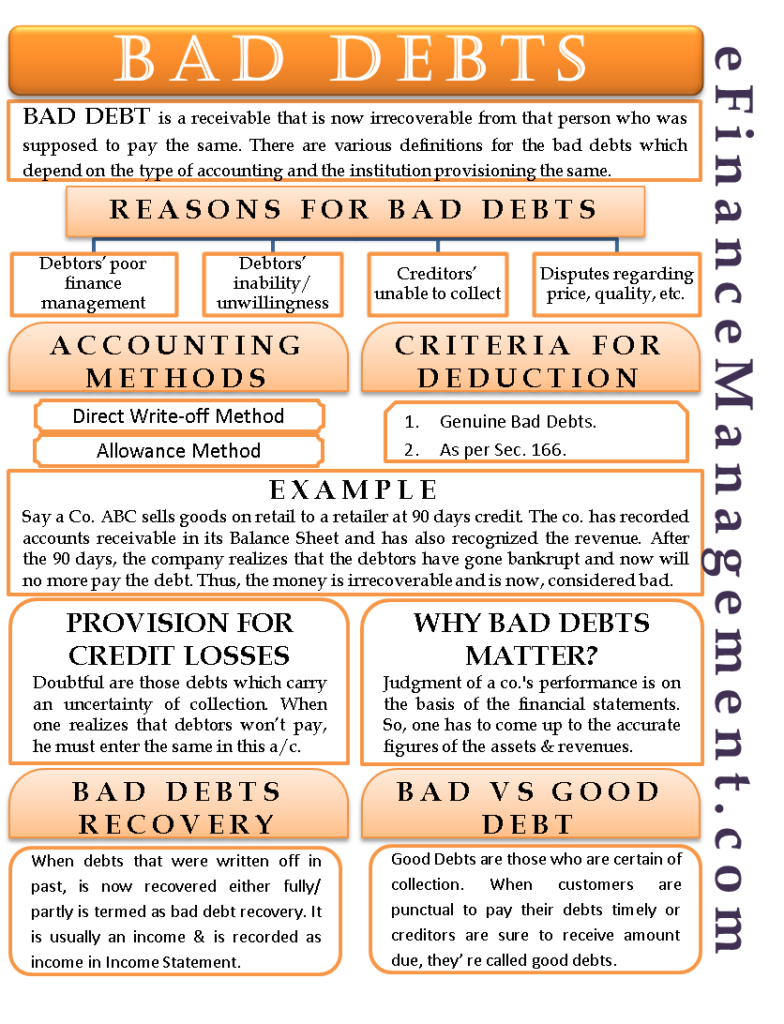

Establishing a healthy credit history goes a long way in your bad debt recovery.

How to recover a bad debt. Ad view editor's #1 pick. You may be able to informally. Here are 5 ways to recover an outstanding debt:

Authorizing for another individual, authorizing a professional debt recovery company. You’ll need to work out if the debt collection fee is worth the cost of recovering the debt. While the debt recovery process may vary from country to country, it typically goes as follows:

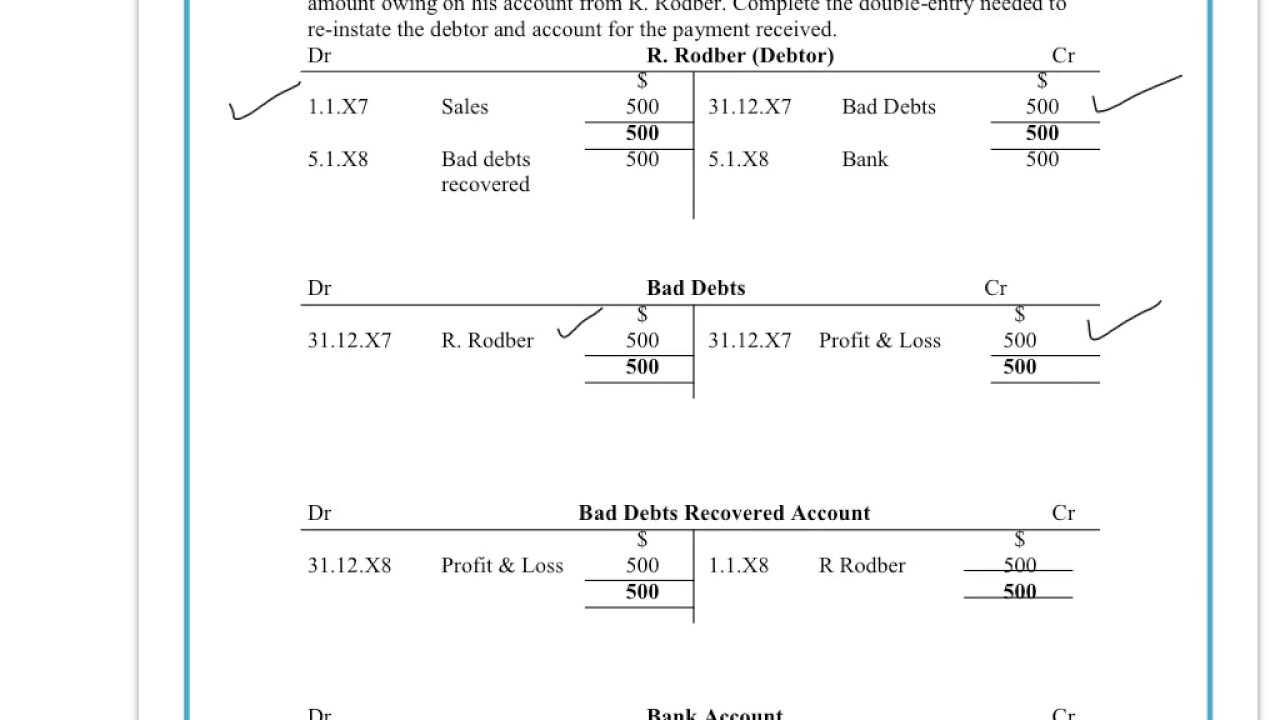

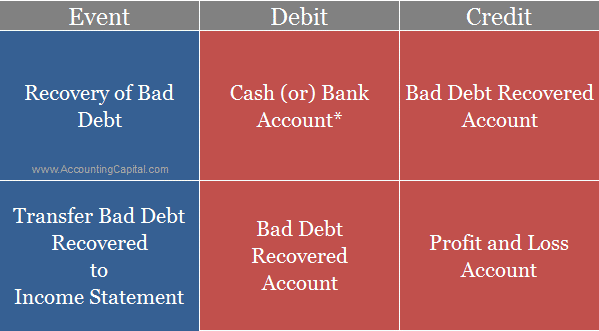

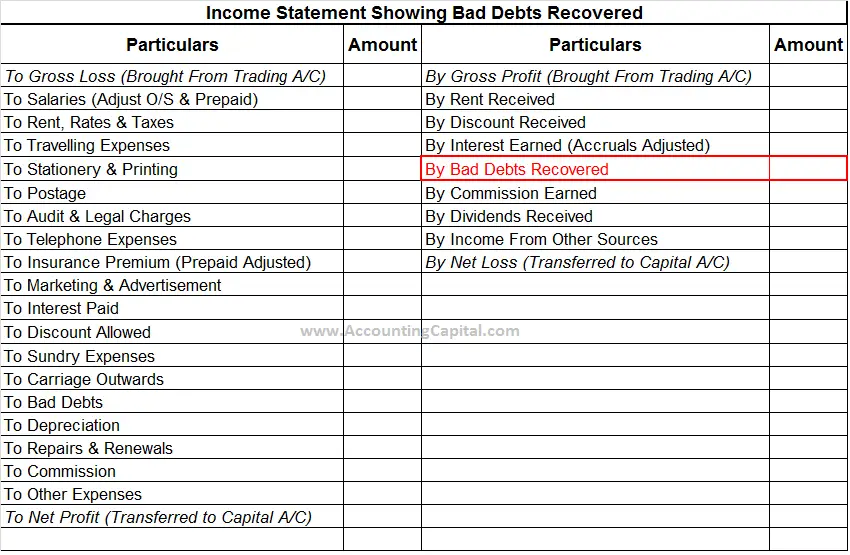

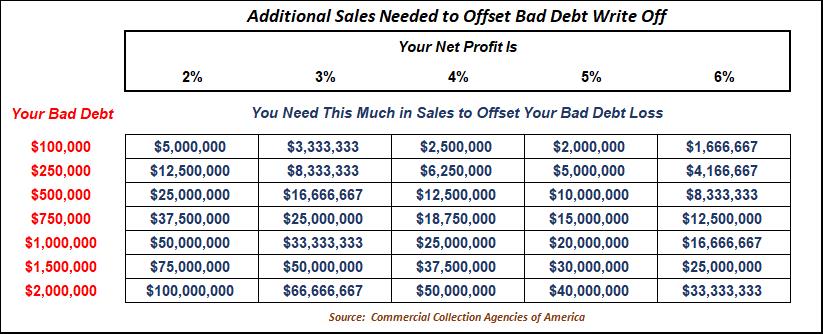

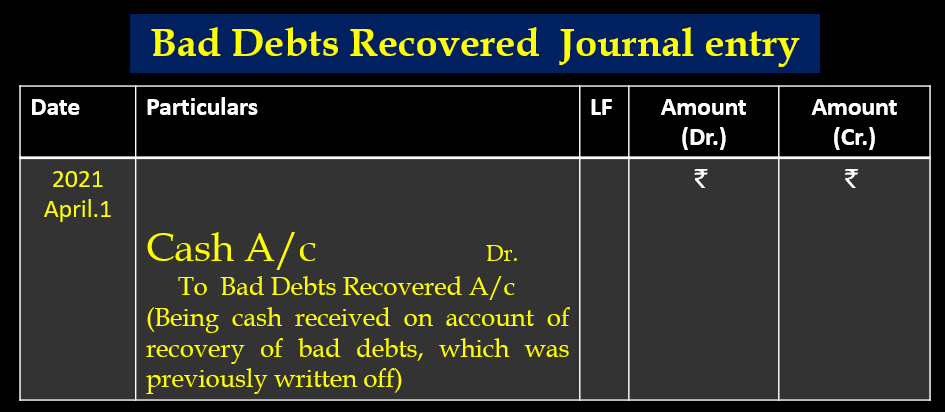

As the bad debt creates a loss for the company initially when recorded as bad debt. Reverse original recordation the first step is to reverse the original recordation of a bad debt. Bad debts impact businesses of all sizes, and can be particularly problematic during an economic downturn, so we’ve asked jarvis atwine, a debt recovery specialist in our.

Unbiased expert reviews & ratings. Mediators are trained professionals appointed to settle the matter between the creditors and the debtors. Ad compare the 5 best debt consolidation companies to find the right partner for you.

Pay down your debt with one easy monthly payment & no upfront fees. Let’s take a look at ways to help you manage and recover bad debts. Ad get your financial house in order without bankruptcy or loan.

One of the most convenient method of recovery of bad debt is mediation. Send the debtor a letter a fairly obvious act that can be done in minutes. This can be done through the use of a secured credit card with a very low monthly limit around.